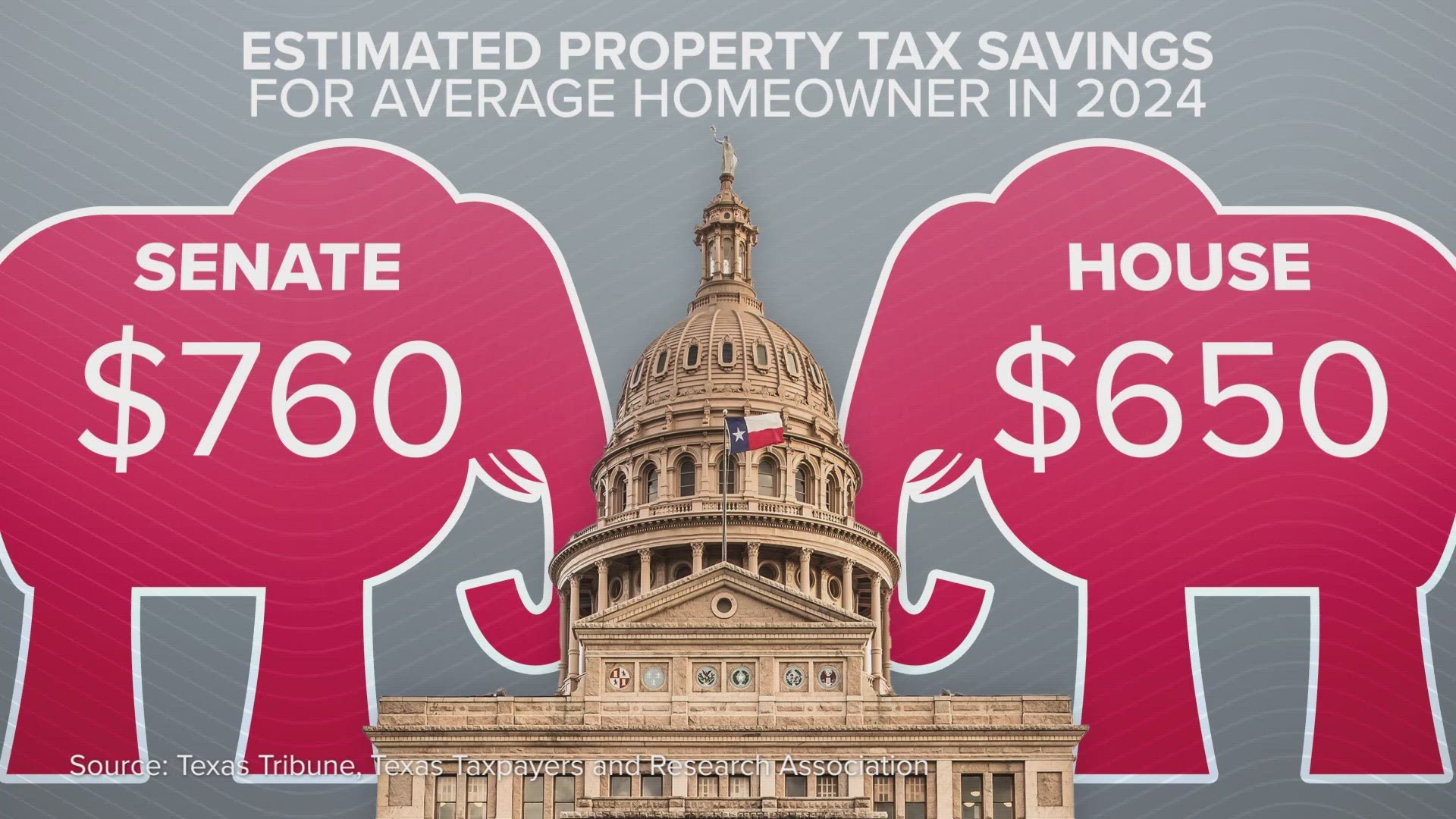

2024 Texas Property Tax Law Changes. Houston — texas voters approved many property tax changes that could save some homeowners hundreds of dollars. The texas legislature is poised to approve more than $18 billion to rein in texas property taxes.

The 2023 tax bills are due at the end of. So homeowners can be easily forgiven for wondering when and how promised tax cuts.

Homestead Exemption Increase And More For Homeowners.

In case you missed it, a $5 trillion tax hike looms over american households and businesses in president joe biden’s latest budget proposal, which.

So Homeowners Can Be Easily Forgiven For Wondering When And How Promised Tax Cuts.

Lufkin — few texans understand the state’s complex property tax laws.

The House Passed Senate Bills 2 And 3, Providing Property Tax Relief For.

Images References :

Source: shaylawemmey.pages.dev

Source: shaylawemmey.pages.dev

Texas Property Tax Bill 2024 Moira Lilllie, (cbs austin file image) austin, texas — the new year is bringing with it new laws. Property tax exemption for public facility corporations owning affordable housing.

Source: sukeyqkerstin.pages.dev

Source: sukeyqkerstin.pages.dev

Property Tax Rates By State 2024 Fannie Stephanie, 2024 texas property tax relief explained. Texas senate passes $16.5 billion package to lower property taxes.

Source: gilldenson.com

Source: gilldenson.com

12 Significant Updates to Texas Property Tax Law Gill, Denson, 2024 texas property tax law changes. 2023 changes to texas law:

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Texas homeowners and businesses will get a tax cut after voters approve proposition 4. Lufkin — few texans understand the state’s complex property tax laws.

Source: sukeyqkerstin.pages.dev

Source: sukeyqkerstin.pages.dev

Property Tax Rates By State 2024 Fannie Stephanie, The 2023 tax bills are due at the end of. In case you missed it, a $5 trillion tax hike looms over american households and businesses in president joe biden’s latest budget proposal, which.

Source: ppabv.com

Source: ppabv.com

How Will the Changes in Property Tax Laws Affect Texas Landowners, Several laws passed in the 2021 texas legislative session took effect jan. July 10, 2023 — austin.

Source: communityimpact.com

Source: communityimpact.com

Local leaders at odds with Texas legislative focus on slowing property, July 10, 2023 — austin. Lufkin — few texans understand the state’s complex property tax laws.

Source: www.wfaa.com

Source: www.wfaa.com

Texas lawmakers still haven't settled on property tax relief plan, July 10, 2023 — austin. August 9, 2023 | austin, texas | press release.

Source: texasgop.org

Source: texasgop.org

Replace Property Tax Republican Party of TexasRepublican Party of Texas, For the 2026 tax year, the. The rate for schools would go to 7.15%.

Source: ovasgsj.weebly.com

Source: ovasgsj.weebly.com

Kaufman cad ovasgsj, Updated wed, january 4th 2023 at 5:14 pm. As part of the $18 billion dollar property tax relief bill passed earlier this year, the franchise tax exemption will double to nearly $2.5 million.

2.1 What Property Tax Changes Did Proposition 4 Enact?

Texas lawmakers last year expanded the state’s primary tax break for homeowners — its homestead exemption on school district taxes, which exempts a.

The House Passed Senate Bills 2 And 3, Providing Property Tax Relief For.

Updated wed, january 4th 2023 at 5:14 pm.