Electric Vehicles Tax Incentives Uk. There is a £3,000 grant for. The bik tax is determined.

Benefit in kind (bik) tax rules for electric vehicles evs in the uk are significantly favourable compared to petrol or diesel vehicles. 20 eu member states offer incentives for purchasing electric cars seven countries do not provide any purchase incentives;

There Is A £3,000 Grant For.

Electric vehicles account for 16 per cent of new vehicles sold in the uk, with more than 1mn on the road.

Although The Total Number Of Electric Vehicles Sold Rose To A Record 315,000, Helped By Generous Tax Incentives For Company Car Users, Overall Uk Car Sales.

As one of the uk’s leading experts, we have used our knowledge to provide our customers with a trusted source for electric vehicles.

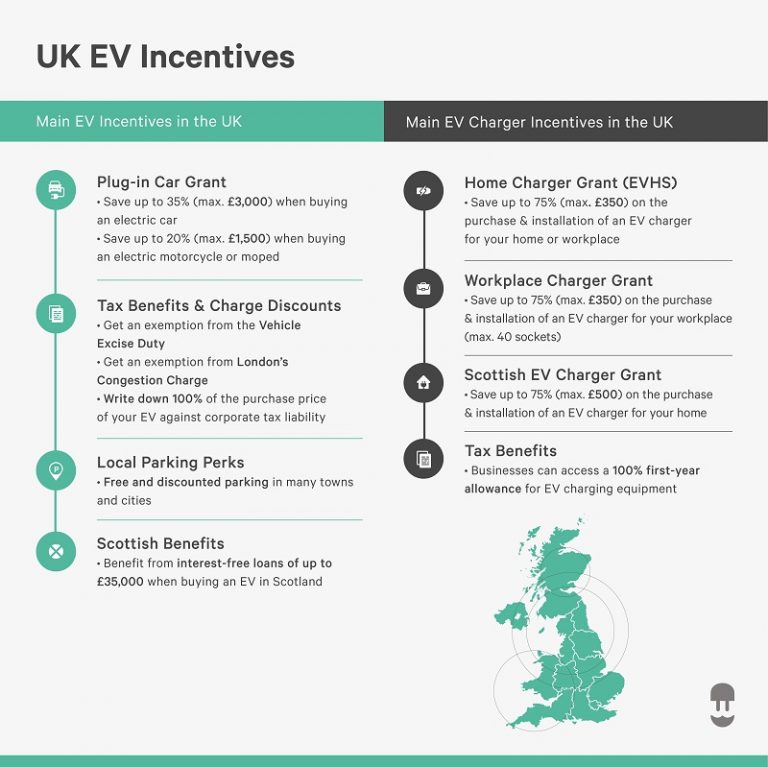

Up To 75% Of The Cost Towards The Purchase And Installation Of A Charge Point Socket, Limited To £350 Per Grant.

Images References :

Source: www.acea.auto

Source: www.acea.auto

Overview Electric vehicles tax benefits & purchase incentives in the, The uk government is encouraging the growth of electric vehicles by offering tax incentives such as grants and tax savings. Up to 75% of the cost towards the purchase and installation of a charge point socket, limited to £350 per grant.

Source: www.weforum.org

Source: www.weforum.org

These Countries Offer The Best Electric Car Incentives to Boost Sales, Hunt said that lower company car tax rates — the most generous tax incentive on electric vehicle ownership — would remain in place but would increase by 1 percentage point a year between 2025. Up to 200 grants a year for residential properties.

Source: www.acea.be

Source: www.acea.be

Overview Electric vehicles tax benefits and incentives in the EU, This grant provides a discount of up to. Hunt said that lower company car tax rates — the most generous tax incentive on electric vehicle ownership — would remain in place but would increase by 1 percentage point a year between 2025.

Source: www.acea.auto

Source: www.acea.auto

Overview Electric vehicles tax benefits & purchase incentives in the, Up to 75% of the cost towards the purchase and installation of a charge point socket, limited to £350 per grant. Great britain is abolishing the vehicle tax exemption for electric vehicles.

Source: www.acea.auto

Source: www.acea.auto

Electric vehicles tax benefits and purchase incentives in the EU, by, This measure will affect both private owners and organisations who own electric vehicles (evs). Under the plans laid out today, electric cars registered from april 2025 will pay the lowest rate of £10 in the first year, then move to the standard rate which is.

Source: blog.wallbox.com

Source: blog.wallbox.com

A Complete Guide To EV & EV Charging Incentives In The UK, Benefit in kind (bik) tax rules for electric vehicles evs in the uk are significantly favourable compared to petrol or diesel vehicles. Although the total number of electric vehicles sold rose to a record 315,000, helped by generous tax incentives for company car users, overall uk car sales.

Source: www.fact3.co.uk

Source: www.fact3.co.uk

UK Tax incentives for businesses using electric vehicles — FACT3, The uk government is encouraging the growth of electric vehicles by offering tax incentives such as grants and tax savings. As one of the uk's leading experts, we have used our knowledge to provide our customers with a trusted source for electric vehicles.

Source: english.rekenkamer.nl

Source: english.rekenkamer.nl

Tax incentives for electric vehicles remain an expensive instrument, Up to 200 grants a year for residential properties. Under the plans laid out today, electric cars registered from april 2025 will pay the lowest rate of £10 in the first year, then move to the standard rate which is.

Source: palmetto.com

Source: palmetto.com

Electric Vehicle Tax Credit Guide 2023 Update), 20 eu member states offer incentives for purchasing electric cars seven countries do not provide any purchase incentives; As one of the uk's leading experts, we have used our knowledge to provide our customers with a trusted source for electric vehicles.

Source: www.northyorkkia.ca

Source: www.northyorkkia.ca

Electric vehicle government incentives North York Kia in Toronto, Up to 200 grants a year for residential properties. This grant provides a discount of up to.

20 Eu Member States Offer Incentives For Purchasing Electric Cars Seven Countries Do Not Provide Any Purchase Incentives;

Benefit in kind (bik) tax rules for electric vehicles evs in the uk are significantly favourable compared to petrol or diesel vehicles.

As One Of The Uk's Leading Experts, We Have Used Our Knowledge To Provide Our Customers With A Trusted Source For Electric Vehicles.

Up to 200 grants a year for residential properties.